Keep your Trade & Commodity Finance

compliant

compliant

Money laundering, sanctions circumvention, terrorism financing, corruption (fraud , bribery, theft, mispricing, embezzlement).

Worried about?

Hi There!

I"m Gulshat

I"m Gulshat

Trade & Commodity Finance Professional

Anti-Money Laundering Specialist (CAMS)

Anti-Money Laundering Specialist (CAMS)

I provide practical services to ensure compliance in Trade & Commodity Finance

Trade and Commodity Finance is simple

but people insist on thinking it is complicated.

but people insist on thinking it is complicated.

The entire concept revolves around ensuring safety and security. It becomes complicated and dangerous when you are not sure of what you are doing and get exploited by the ones who are.

Risks related to money laundering, sanctions circumventions, fraud, bribery, and terrorism financing.

These risks arise due to the large volumes involved, multiple parties from different territories, complexity of instruments & products, geopolitical instability and economic sanctions.

The challenge is finding the right balance between being compliant and still being able to continue business.

Barrage of constantly evolving regulatory requirements, economic and financial sanctions, parts that can not be automated yet and require discerning human eye in the loop.

I can speak KZ, RU, EN, TR with you

OVER 12-YEARS IN Trade & Commodity finance.

FROM RM TO DESK HEAD

FROM RM TO DESK HEAD

- Individually – onboarded 21 mid and large size clients, EUR 600 million transactional lines, 42 new KYC/EDD.

- 2 files passed scrutiny of external compliance and credit risk audits with only minor comments,

- Many visits to ports, warehouses, offices, fields, factories. Reality might not always align with our perceptions and imaginations based on papers and from office seats.

- Countless Credit and compliance committees. Advocating for clients internally, while fighting for the bank's interests externally.

'This is How We Do It' is not really enough, dive deeper.

- Refused to onboard three large international clients due to a mismatch in financial performance, business model and market reality. Two filed for bankruptcy, one is no longer active.

- Collected two substantial proceeds on time, by closely monitoring market developments and transactions. One fired top management and closed the office, another stopped operations.

- Many transactions declined due to illogical parties, credit risk, questionable routes, economic irrationality, etc. Most of them were successfully financed by other banks.

- Many transactions executed with changes and adjustments of terms to diminish or avoid risks. No questions so far, but who knows what can happen in the future.

- Closely worked with internal and external Compliance and Sanctions experts. Helped themin interpretation of financial instruments to assess the effect of new regulations and sanctions on services and portfolio.

Responsibility and accountability

- Initiated exit from two highly profitable large international clients, because uncovered falsification of documents and signatures, suspicion of sanctions circumvention. One is still in the market, another closed the company.

- Refused to onboard one large international client, suspicion of sanctions circumvention in some of transactions. The doubts were later supported by market checks.

Business is business, nothing personal, but attitude and relationships truly matter.

- Collected one substantial proceed thanks to clear communication from the beginning and strong relationship with the client.

- Onboarded many large international traders despite of the facility size and structure the bank could offer.

- Market information, knowledge and insights shared by clients.

Background, opportunity, environment, and practice

- Credits to the amazing support, encouragement, guidance, and knowledge of my incredible circle, including family, friends, colleagues, managers, clients, and counterparties.

AFTER NEARLY 20 YEARS IN THE BANKING, STARTED SOLO CONSULTANCY IN LATE 2022

Confidence in my expertise and skills combined with a desire for more freedom and independence.

MY SERVICES

See Unusual

Hear Through

Speak Truth

Today, banks are more likely to close accounts and turn down new account applications, mainly because of compliance concerns.

KYC Packages for Account Opening

close

- Endless rounds of questions?

- Weeks and months of uncertainty?

- Not knowing whether to share certain information or not?

- The bank didn't ask, so you haven't disclosed it yet?

- The same questions all over again after a few months?

- Out of the bank's risk appetite?

In many cases, issues are caused by erroneous presentation of file due to misconception of risks

- According to best-practice model of EU banks

- Cut down on question rounds to make the process more efficient

- Save precious time by eliminating unnecessary back-and-forth

- Helps to get banks decisions more informed and swiftly

In the process or about to start?

Get complete KYC package

A package that clearly outlines your business model, reasoning, and backs it up with supporting documents, leads to a smooth and effective communication with banks.

There is no “absolute" for the risk assessment in Trade Finance. It must be evaluated in the context in which it is being used.

Customer due diligence (CDD/EDD)

close

Wealth of information is crucial. Yet, the perspective we choose and how we interpret that information holds true significance.

The sector is unregulated, often lacking transparency, that's why practical experience and market insight is crucial.

Let me help

- Overwhelming number of parties involved

- Counterparties are spread across multiple regions

- High amounts of transaction

- Wide range of products & instruments to be used

- High potential risk of sanctions violations, money laundering, fraud., bribery and embezzlement

- Any signs of camouflaged risks

- Does the big picture seem to make sense (UBOs, geographies, products, logistics, transactions etc)

- Is the storyline align with the market's actual conditions?

- Does the financial performance correspond to the market's reality

Confused?

Sort and organize the information

Read between the lines, discuss sensitive questions

Work for more disclosure

and checks

and checks

a)

b)

c)

The key is to have sector insight and technical expertise

Transaction due diligence (TDD)

close

Avoiding any unexpected surprises after the transaction or commitment is essential.

The key is to have sector insight and technical expertise.

- Sanctions circumvention

- Money laundering

- Terrorism financing

- Corruption

- Fraud

Worried about risks like?

- Does the transaction structure appear logical?

- Is the geographical aspect coherent?

- Do the documents appear accurate and adequate?

- Are the profit margins sensible?

- Do the involved parties align with their respective roles?

- Are there excessive parties involved?

- Do payment terms make sense?

- Does requested service make sense ?

Make sure to have it checked

Check the company, market trends, and patterns.

b)

a)

c)

Discover how different elements linked to each other

Uncover any hidden or disguised risks

Compliance stopped being a tick box exercise

Building corporate compliance program

close

Most organizations conduct checks to protect their own interests, though these may not always be consistent, documented, or recorded.

To ensure compliance with laws, rules, and regulations, every organization should have a comprehensive set of internal policies and procedures.

Get complete Compliance Program

- Reality translated into practical compliance

- Reducing the risk of penalties, fines, lawsuits or shutdown of your business

Risk Control

Policies & Procedures

- Not sure where to begin?

- Confused about what needs to be documented and how?

- Curious about the market standards in such situations?

- Modification

- Development

Time to organize internal processes?

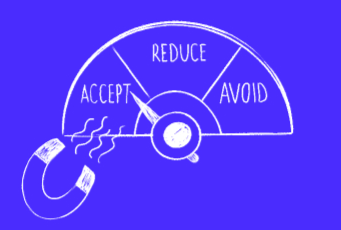

- Accept

- Reduce

- Avoid

Risk identification

c)

d)

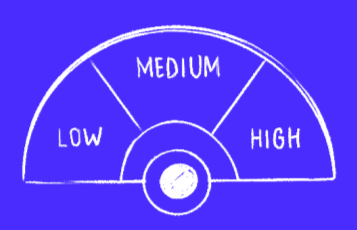

Risk classification

- Low

- Medium

- High

b)

- Ownership structure and percentages

- Source of funds and assets

- Business nature (transactions, countries, payments and delivery terms, collaterals etc)

- AML policies and procedures

- UBOs and their backgrounds

a)

Services can cater to your needs

- Online or in-person

- Individual or a group

- Particular project or question

Have questions or need a help?

I share what I’ve learned along the way.

MY REFLECTIONS

+31 (0) 623 79 04 74

2024 Kona Diligence. All Rights Reserved.